Best Portfolio Managers in India

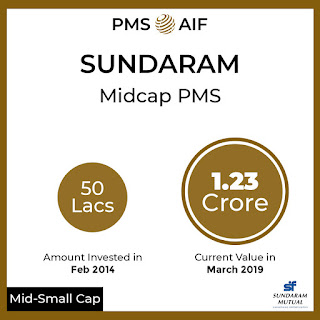

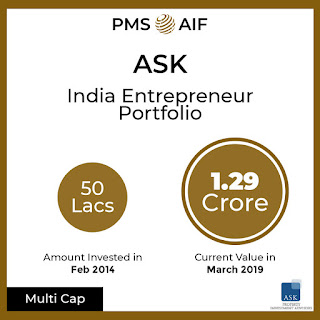

Year 2018, 2019and 2020 were difficult year for equity markets, as broader markets did not perform in 2018 and 2019 and even front line companies underperformed in 2020 owing to COVID 19. Most equity investment products that were linked to broader markets had exposure in cyclical sectors like auto, real estate, infrastructure did not perform. Portfolios that had exposure to mid&small cap companies also did not perform. However, at the same time, front end markets made their life time highs in Dec 2019, and so the best PMS for 2019 were those which had larger exposure to Blue-Chip and Quality Companies. Best fivePMSesbased on the recent past performance ( Year 2018 & 2019 ) are 1) Marcellus Consistent Compounders , 2) Stallion Asset Core Fund, 3) IIFL Multi Cap PMS , 4) Ambit Coffee CAN, 5) ASK India Entrepreneurial Portfolio . ...