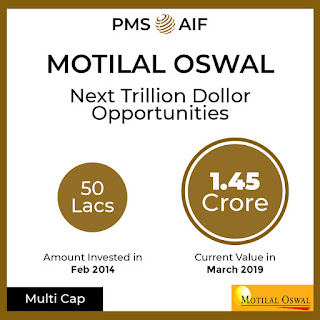

Portfolio Management Services | PMS AIF

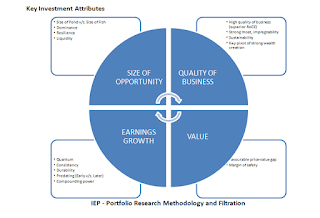

The art of selecting the right investment coverage for the people in terms of minimal chance and most go back is known as portfolio management Services. Portfolio control refers to handling a man or woman’s investments within the shape of bonds, shares, cash, mutual funds etc. so that he earns the most profits in the stipulated time frame. Portfolio Management Services refers to dealing with the money of a character below the professional steering of portfolio managers. In a layman’s language, the artwork of managing a man or woman’s investment is referred to as Portfolio management Services .