ASK IEP(India Entrepreneurial PMS )

Portfolio of Large and Growing Companies

with Promotors Significant Skin in the Game

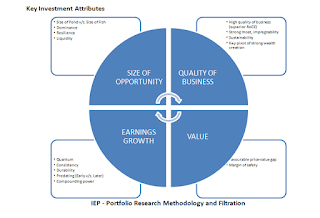

Key Attributes

·

Inception Date: 25 January 2010

·

Number of Stocks: 19

·

Fund Manager Name: MrSumit Jain

·

Fund Manager Experience: Total Exp – 12

Years, With ASK – 11 Years

·

Fund Manager Qualification: Post Graduate

in Management from Mumbai University.

Investment Objective

The concept of ASK IEP PMS invests in Indian

entrepreneurs with adequate ‘Skin in the Game’ who have demonstrated high

standards of governance, vision, execution, wisdom, capital allocation, and

capital distribution skills. They run businesses that are amongst the highest

long-term earnings growth.

Investment Philosophy

1) ASK IEP PMSidentifies

large and growing business opportunities with a competitive advantage that are

significant sized (min Rs. 100cr of PBT)

2) The quality of the business should be

good to be able to fund strong growth through internal cash generation. So, it

looks for 20% compounded growth from each business and targets over 25% growth

from the portfolio

3) To fund this growth, the business ROCE

should be over 25% so that growth can be funded and there are surpluses for

dividend

4) The management should have the drive and

have skin in the game to deliver compounded growth period after period

(uncompromised corporate governance is a must). Hence, invest in businesses

with an identifiable business house at the helm with a minimum 25% stake.

5) We seek to identify such businesses at

reasonable discount to value and stay invested for a length of time and make

money as EPS compounds

ASK’s Advantage -"Investing",

as Buffett says, "is simple but not easy". It is the implementation

of the simple things consistently and with discipline during all market

conditions, that requires character, which makes all the critical difference.

Core advantage lies in the disciplined and consistent execution of these

'simple' things and doing them well.

Investment Philosophy - Core philosophy at ASK IEP PMS Investment

Managers revolve around two key aspects:

1)

First, achieve capital protection (over time) and

2)

Follow it with capital appreciation.

Seeks to invest in Indian equities that run

high-quality businesses, operated by high-quality management, enjoying

sustained long-term growth prospects at fair and reasonable prices.

Overarching Investing Philosophy and

Principles

·

Greater certainty of earnings v/s. mere quantum

of earnings growth

· The superior and consistent quality of earnings v/s.

mere quantum of earnings growth

·

High quality at a reasonable price v/s. inferior

quality at an arithmetically 'cheap' price

Comments

Post a Comment